Forecasting Model on Home Loans

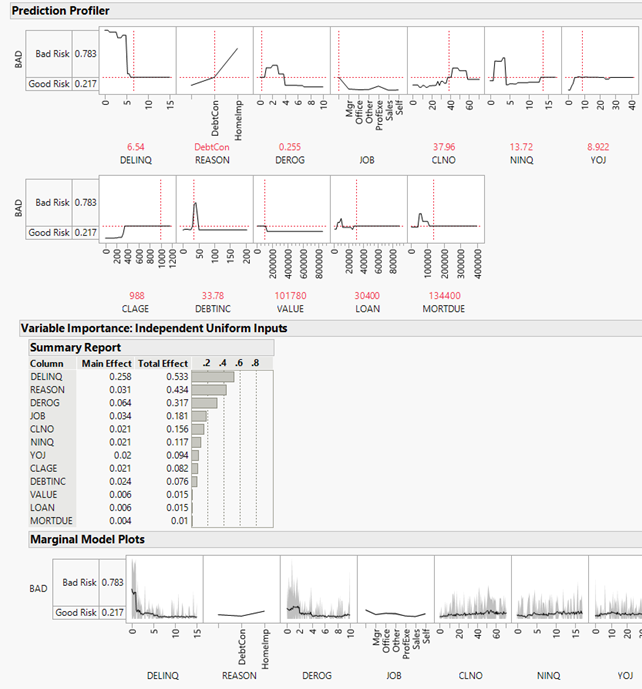

This project looks at the amount of the loan, their current mortgage amount, their assessed value, the reason for their loan, what category their job falls under, YOJ is years at their job (the longer the better), DEROG is number of derogatory reports (the lower the better), DELINQ is the number of Number of Delinquent Credits (the lower the better), CLAGE is age of oldest credit (older the better), NINQ is the number of credit queries (the lower the better), CLNO is the open number of credit lines (number can be debatable on if they pay on time or not), and DEBTINC is debt to income ratio.

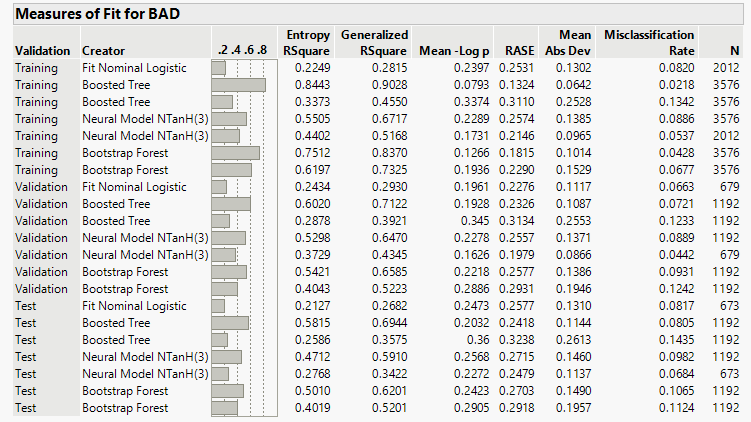

I started my analysis by manually breaking this data down by Training (60%), Validation (20%), and Test data (20%) within a validation column. There is some randomness in the Neural Networks and Random Forests and Boosted Trees on where they start analyzing the data from so running this multiple times might not yield the same exact result.

The best part of employing the boosted trees modeling is that it learns from its mistakes and then rebuilds the model over and over putting more weight into these errors until it can no longer improve. Once it has reached it peek performance, it takes an average of the results. By using this average, it confirms that the predictions are stable.

For the full report click here.

Overall, the data shouldn’t be surprising for those who have applied for any type of credit line before. You know your credit score considers your length of history, the amount of utilization, any missed payments. I do like seeing the “bigger picture” of how those with larger mortgages and those who are taking out larger loan amounts seem to also be taking it out for home improvement reasons. This will just add more value to the home and lower your debt-to-income ratio which is another variable that does have an impact. Allowing those who are in good financial standing to improve their standing even more.

The lessons learned – pay off what debt you have, ones that are high interest or large dollar amounts, keep making payments on time. That way, when eventually one does buy a home and want to increase their equity and thus net worth it will really payoff.